Building Sustainable Token Economics: A Guide for Early-Stage Web3 Projects

1. Introduction: The Challenge of Sustainable Token Economics

In the early days of crypto, token design was simple: launch a coin, attract users, and hope for price appreciation. But as the Web3 ecosystem has matured, so have the expectations around tokenomics. Today, merely issuing a token is not enough—sustainability is the defining challenge for early-stage projects.

Poorly designed token economies are fragile. Many Web3 projects fail not because their technology lacks promise but because their economic models are unsustainable—leading to inflationary collapse, weak user incentives, or speculative boom-and-bust cycles. Investors and users have become more sophisticated; they no longer buy into “just another token” unless it offers real utility, meaningful incentives, and long-term value capture.

For Web3 founders, designing sustainable tokenomics is as important as building great technology. A project’s success hinges on the balance between incentives, scarcity, and value accrual mechanisms. Tokens should not only drive growth but also ensure the long-term health of the network.

In this guide, we explore:

Core principles of sustainable token economics

Common pitfalls in early-stage token design

Strategies for creating long-term utility and value capture

How to align token incentives across users, developers, and investors

The evolving role of governance and decentralized economic models

By the end, early-stage Web3 teams will have a framework for designing a token economy that scales sustainably—attracting the right stakeholders while avoiding pitfalls that have doomed past projects.

2. Tokenomics 101: Core Principles of a Healthy Token Economy

At its heart, token economics (or tokenomics) is the set of rules that define how a token is issued, distributed, and used within a network. Sustainable tokenomics must balance supply and demand, incentives, and governance to create a self-sustaining economy.

2.1 The Three Core Functions of a Web3 Token

Not all tokens are created equal. Depending on the use case, tokens serve different functions, and clarity on this early in the project lifecycle is essential.

Utility Token: These tokens serve a functional purpose within a network—whether for payments, staking, accessing services, or facilitating transactions (e.g., ETH for gas fees on Ethereum).

Governance Token: Used to participate in decision-making for decentralized protocols (e.g., UNI in Uniswap governance).

Store-of-Value / Reward Token: Often used in staking or DeFi protocols, these tokens incentivize behavior but must have proper economic balancing to avoid hyperinflation (e.g., AAVE rewards in DeFi lending).

A single token can serve multiple roles, but founders must design economic structures that prevent over-inflation, ensure long-term demand, and provide real utility beyond speculation.

2.2 The Three Pillars of Sustainable Tokenomics

A robust token economy is built on three interlocking principles:

Incentives: A well-structured reward system encourages productive participation from users, validators, and developers.

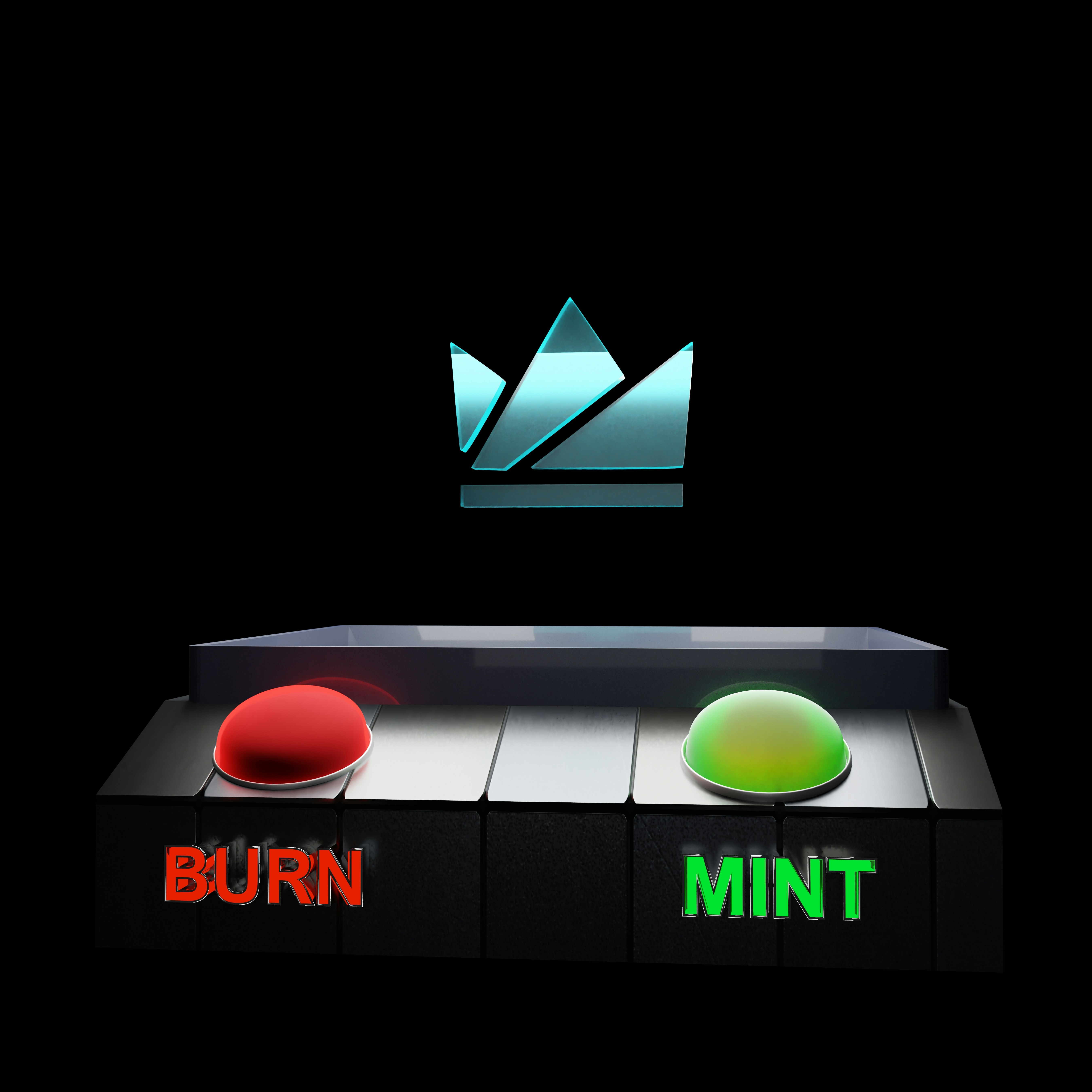

Scarcity: Supply mechanisms (burning, staking, fees) should prevent oversupply and ensure long-term value retention.

Value Capture: Token holders must have clear value accrual mechanisms, such as fee-sharing, governance rights, or exclusive ecosystem benefits.

Many early-stage projects fail because they over-reward early participants without a plan for long-term utility. Creating a token that survives beyond its initial hype requires careful economic modeling.

3. The Biggest Pitfalls in Early-Stage Token Design

Many Web3 projects struggle due to poor token design choices that create misaligned incentives. Let’s examine the most common mistakes.

3.1 Over-Reliance on Inflationary Rewards

Many DeFi and GameFi projects rely on high initial token emissions to attract liquidity providers, stakers, or users. While this can drive rapid adoption, excessive token emissions create selling pressure, leading to inevitable price collapse when incentives dry up.

Example: Axie Infinity (AXS & SLP)

Axie’s “play-to-earn” model initially drove exponential growth, rewarding players with Smooth Love Potion (SLP) tokens.

However, there was no strong burn mechanism or sustainable demand for SLP beyond player payouts.

As new users slowed, selling pressure overwhelmed the economy, leading to token price crashes and ecosystem stagnation.

Solution:

Implement dynamic reward adjustments to prevent excessive emissions.

Introduce burning mechanisms or lock-up periods to reduce sell pressure.

Create alternative demand sources for the token beyond speculation.

3.2 Poorly Designed Governance Tokens

Governance tokens are often issued too early before a real community forms, leading to low participation rates and governance capture by whales.

Example: Uniswap (UNI) Governance Challenges

Uniswap’s governance token (UNI) gave holders voting rights over treasury funds and protocol upgrades.

However, voter turnout was extremely low in major proposals—most token holders did not participate.

Large token holders (whales & VCs) dominated decisions, leading to questions about true decentralization.

Solution:

Delay full governance decentralization until active stakeholders emerge.

Use progressive decentralization—start with core contributors, then transition governance to token holders gradually.

Introduce delegate-based voting models to encourage active participation.

3.3 Unsustainable Liquidity Mining & Ponzinomics

Liquidity mining incentives (paying users with native tokens for providing liquidity) can be a short-term growth hack but a long-term risk if mismanaged.

Example: Olympus DAO (OHM) and Unsustainable APY Models

Olympus DAO launched with extremely high staking APYs (over 1,000%).

This attracted speculators looking for quick gains rather than long-term participation.

Eventually, as rewards diluted token value, the model collapsed.

Solution:

Avoid excessively high liquidity incentives that cannot sustain long-term.

Implement real yield models where rewards come from actual revenue, not inflation.

Explore bonding mechanisms (users buy discounted tokens for long-term commitment).

4. Designing a Sustainable Token Economy

4.1 Sustainable Supply & Demand Balance

A well-designed token economy must balance supply-side mechanics (issuance, staking, burning) with demand-side mechanics (utility, payments, governance rights).

Supply-Side Controls

Capped Supply: Fixed token supply (e.g., Bitcoin’s 21M limit) ensures scarcity.

Burn Mechanisms: Tokens removed from circulation via fees or transactions (e.g., Ethereum’s EIP-1559 burn model).

Staking & Lock-Ups: Incentivizes users to hold tokens rather than sell immediately.

Demand-Side Utilities

Payment for Services: Ensure the token has real-world usage within the ecosystem.

Fee Discounts or Rewards: Holders benefit from reduced fees or increased rewards (e.g., Binance BNB).

Exclusive Access: Provide access to gated content, premium features, or governance.

4.2 Designing Fair Token Distribution

Early-stage projects must carefully allocate tokens to ensure fairness and avoid centralization.

Allocation Type Recommended % Purpose Community / Incentives 30-50% Rewards for early adopters, staking, liquidity providers Team & Founders 15-25% Ensures long-term commitment (vesting required) Investors / VCs 10-20% Capital for development & expansion Treasury / Reserve 10-20% Long-term sustainability, partnerships Public Sale 5-10% Distribution to retail investors

Key Distribution Considerations

Vesting Periods: Prevent early investors or team members from dumping tokens.

Gradual Unlocking Mechanisms: Slow, predictable releases rather than large cliffs.

Fair Launch vs. Private Sales: Projects must balance early investor interest with community ownership.

5. The Future of Tokenomics: Beyond Speculation

As Web3 evolves, tokenomics must mature beyond speculation-driven models. The next generation of token economies will emphasize real economic activity, not artificial hype cycles.

Emerging Trends

Protocol-Owned Liquidity (e.g., Olympus DAO bonds): Rather than renting liquidity, projects own their liquidity pools, reducing reliance on mercenary capital.

Revenue-Backed Tokens (e.g., GMX, Real Yield Models): Token rewards come from actual platform revenue, ensuring sustainability.

Multi-Token Economies: Some projects separate governance from utility tokens to prevent governance capture while maintaining strong incentives.

Founders who embrace these principles will build resilient projects that stand the test of time. The Web3 ecosystem is shifting toward real utility, sustainable growth, and well-balanced token economies—those who adapt will thrive.

6. Conclusion: The Path to Long-Term Token Sustainability

Tokenomics is not just about fundraising—it’s about building a functional, incentive-aligned economy that can sustain itself. Early-stage Web3 founders must think beyond short-term hype and design systems that provide lasting value to users, developers, and investors alike.

By avoiding inflationary traps, designing strong incentives, and ensuring utility-driven demand, projects can build truly sustainable token economies—ones that will not only survive but define the next era of decentralized finance, gaming, and Web3 infrastructure.